philadelphia wage tax refund

Here are the new rates. The new Philadelphia Tax Center is accepting 2021 refund requests now.

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

- Wage Tax Refund Request.

. Electronically file your 1099 forms. CalloutIn view of major disruptions to business by the coronavirus pandemic weve created special Wage Tax refund forms only for 2020. Do I include anything in Double.

All Philadelphia residents owe the Wage Tax. I also added her state wages to our NJ return to pay taxes that are owed to NJ. Click for W2 Instructions.

Electronically file your W-2 forms. - Wage Tax Refund Request. I am going to file a PA return to request a refund for all of the state taxes paid to PA.

Click for Wage Instructions. They only withheld PA income taxes. January to August 2021 Depopulation of Campus If you are a nonresident of Philadelphia and worked remotely during the extended University depopulation from January through August 2021 Philadelphia City Wage.

How do I go about getting credit for these taxes. Click for 1099 Instructions. Here are the new rates.

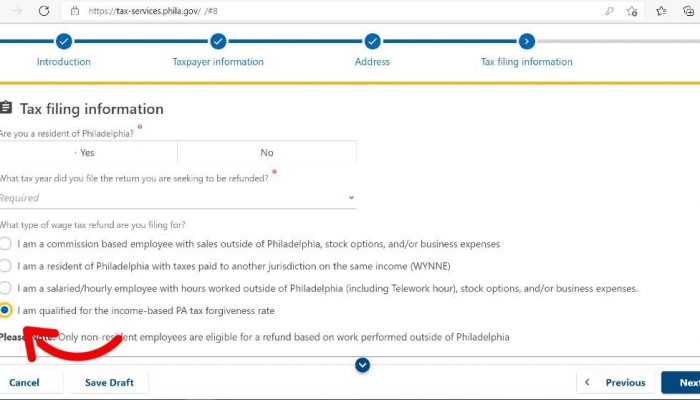

Click for Wage Instructions. Electronically file your W-2 forms. Taxpayers do not need to create a username or password to request a wage tax refund Lopez Kriss said.

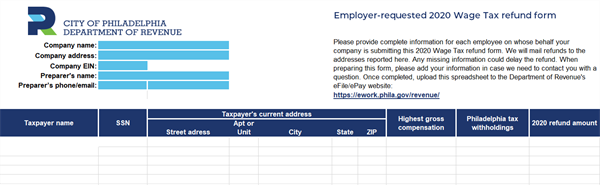

These include an employer-requested form and simplified paper versions. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. Callout These forms help taxpayers file 2020 Wage Tax.

I believe I can add it to the NJ state tax return. Electronically file your 1099 forms. She also paid Philadelphia wage tax.

You can now also request any Wage Tax refund online. Philadelphia residents are subject to City Wage tax withholding regardless of where they worked and are not eligible to request a wage tax refund. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax.

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. Click for W2 Instructions. Click for 1099 Instructions.

The new Wage Tax rate for residents is 38398.

Limits Of Salary Deductions Surcharges And Salary Advances Wage Garnishment Wage Tax Debt

How To Get Your Philly Wage Tax Refund Morning Newsletter

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Refund Program Goes Online To Ease Process

Success Wage Tax Refund R Philadelphia

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

Covid Makes Everything Difficult But Philly Makes Tax Refunds Easier

How To Get Your Philly Wage Tax Refund Morning Newsletter

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

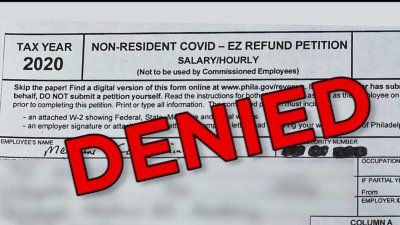

Philadelphia Wage Tax Refunds Delayed Due To 500 Increase In Applications Nbc10 Philadelphia

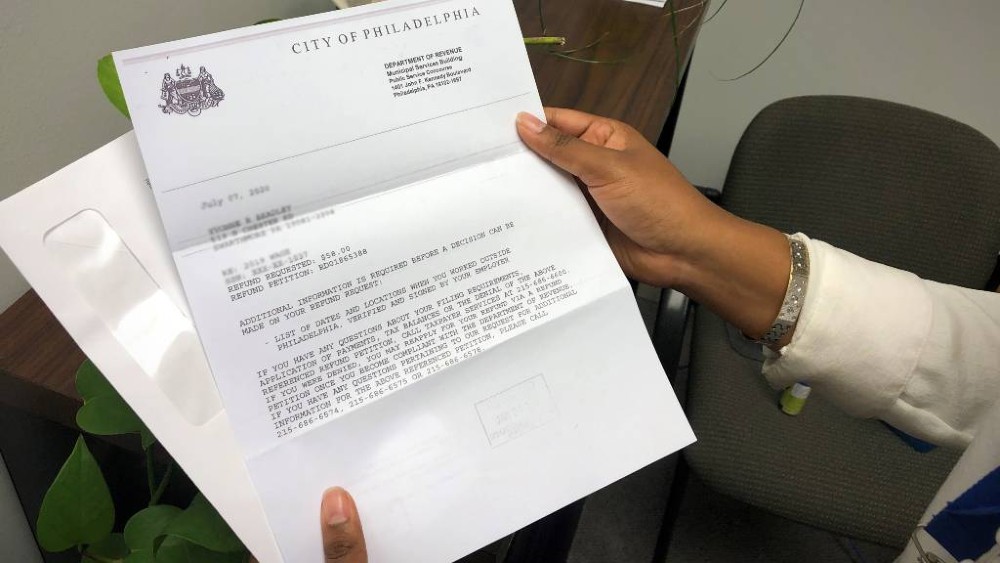

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

/cloudfront-us-east-1.images.arcpublishing.com/pmn/JJVOE3MU7BD5XHJ3LOWCOOJTVU.jpg)

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

What Is Tax Loss Harvesting And How Does It Work Centsai Tax Time Capital Gains Tax Tax

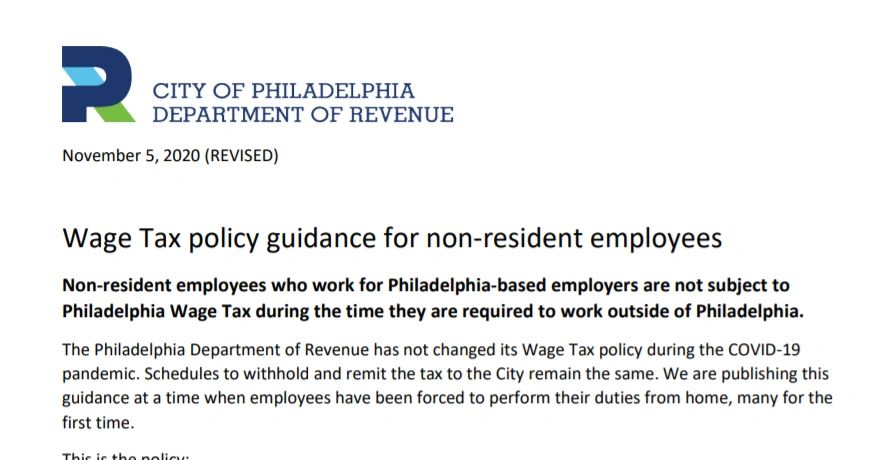

Working From Home For A Philadelphia Based Employer

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Intercultural Family Services Inc Site Description Behavioral Health Services Employment Opportunities Intercultural

5 Things To Know About Wage Tax Department Of Revenue City Of Philadelphia